The Challenges of Grocery Ecommerce

Dustin Crandall | 11 August 2021

There’s no question that online grocery ordering is here to stay. Access to fresh produce, milk, eggs, toilet paper and many more grocery items isn’t changing. However, the process by which those products get delivered to the consumer from distribution centers – that is being re-envisioned to meet changing consumer demands. And, with that come new challenges, technologies and strategies. Let’s first look back at history.

Prior to 1916, grocery stores were not self-service. A customer gave their grocery list to a store clerk, then the clerk walked the aisles to pick and pack the items on the customer’s behalf. This costly, labor-intensive approach led to higher operating costs, which translated into higher prices for customers.

In 1916, Clarence Saunders opened the first Piggly Wiggly in Memphis, Tennessee. This was the first self-service grocery store in the U.S. For the first time, customers could walk through the aisles and pick their own items, which significantly reduced the number of clerks needed. This reduction of operating costs allowed Piggly Wiggly to pass the savings on to the customers in the form of lower prices.

What started as a lone store quickly grew into a highly successful chain, peaking at over 2,600 stores in 1932. Grocery store chain Humpty Dumpty’s introduction of shopping carts in the mid-1930s further enhanced the Piggly Wiggly model, becoming the industry standard that is still widely deployed today.

Price Competition and Falling Margins

Even after broad adoption of the self-service model, the U.S. grocery store industry has been a notoriously low-margin business. Ironically, uniform adoption of the self-service model has been a contributing factor. Walk into nearly any grocery store in the U.S. today, large or small, and both the layout and customer experience will be basically the same. The primary differentiator between stores has been price.

Customers, who benefited from reduced prices, have come to demand near 24-hour access along with high variety and ever-present availability. Group all these factors together with high operating costs, particularly for large supermarkets, and the net margins have become very low.

Ecommerce, the Coronavirus Pandemic and Changing Expectations

Now enter online customers who expect the same variety and availability at little to no premium on price. During the past decade, customer purchasing habits and expectations evolved, trending more and more toward ecommerce. The COVID-19 pandemic accelerated this trend.

It’s no secret ecommerce sales in the U.S. were boosted during the COVID-19 pandemic. According to Digital Commerce 360, the U.S. Department of Commerce estimates online sales increased at a rate of roughly 15% per year from 2016 to 2019. Ecommerce sales jumped 44% from 2019 to 2020 due in large part to the pandemic.

Many consumers felt compelled to try online ordering for the first time during the pandemic. It is expected that most will continue shopping online in 2021 and beyond.

Approaches to Online Grocery Order Fulfillment

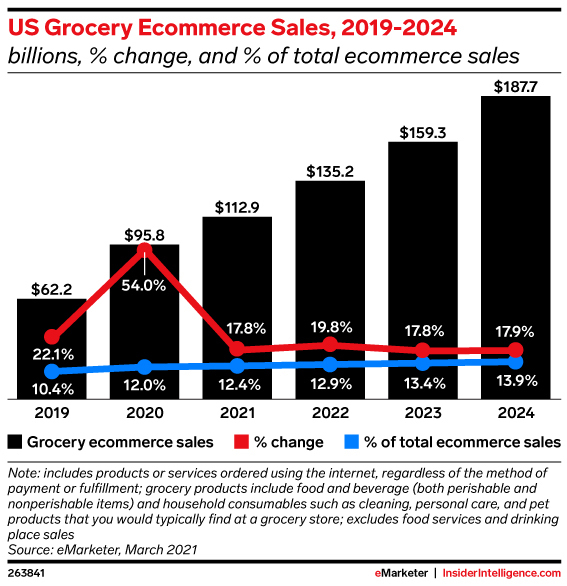

With consumers trending toward ecommerce, where does grocery fit into the equation? According to a March 2021 report by eMarketer, online grocery sales grew from $62.2 billion in 2019 to $95.8 billion in 2020, a 54% increase.

Although this huge leap can be partly attributed to the pandemic, forecasters predict many grocery buyers will continue purchasing groceries online due to the convenience. There is no doubt some shoppers will return to stores; however, those who continue buying groceries online will help push spending above $100 billion in 2021. Online grocery sales were previously not expected to crest $100 billion until 2022. As customer purchasing habits and expectations continue to evolve, trending more and more toward ecommerce, online grocery sales forecasts appear to warrant deviation from the tried-and-true self-service model.

What options do grocery retailers have?

Although grocery retailers cannot ignore the opportunity these forecasts represent, there is not yet a Piggly Wiggly-type uniform approach to recognizing these sales. Numerous approaches are being explored by grocery retailers.

What follows is an overview of some of the more popular methods along with advantages and challenges of each:

Curbside Pickup or Buy Online, Pick Up In Store (BOPIS)

- Placing the Order: The customer uses the store’s website or mobile app to select a specific store, then places an order. The customer chooses a date and timeslot for picking up the order.

- Fulfilling the Order: A store employee gathers items for the order directly from the store shelves. The items are then staged until the customer arrives. Staging may take place in a temperature-controlled area inside the store. Alternatively, the order may be staged in a grocery pickup locker or automated pickup depot that customers can access by drive through.

- Picking Up the Order: The customer will receive a notification, via phone call, text message or email, when the order is ready.?

- For “traditional” curbside pickup: At the store, the customer will drive to a designated parking area and communicate the parking stall number, often via text. A store employee will deliver the prepared order and load it into the customer’s vehicle.

- For locker or automated depot pickup: At the store, the customer will access a drive through to retrieve the order from the assigned locker or depot slot.

- Who Does This: Most, if not all, major grocery retailers have adopted this service. Curbside pickup became particularly popular for consumers during the COVID-19 pandemic.

- Advantages: Retailers utilize existing brick-and-mortar infrastructure to service online orders. Through this approach, retailers offer free pickup (often with a minimum order value). Many provide same-day pickup within a few hours after order placement.

- Challenges: Stores must manage and operate an ecommerce platform. Stores must add dedicated employees to collect, pack, stage, and deliver orders. The entire process requires labor that had been removed by adopting the self-service model. Moreover, these employees navigate through the same aisles as the in-store customers, which risks souring the experience of those customers. Introducing the indoor staging and outdoor parking pickup areas to pre-existing stores requires construction renovation projects and/or reclaiming footprint at the front of the store that was previously leased to external vendors. Finally, parking lots must have dedicated spaces for curbside customers and/or drive through areas.

Direct Delivery

- Placing the Order: The customer places an order through the retailer’s website or mobile app. The customer to chooses a date and timeslot for delivery.

- Fulfilling the Order: The order is routed to a local fulfillment center or store based on the customer’s zip code. Fulfillment center store employees pick, pack, and ship the order directly to the customer.

- Delivering the Order: Orders are delivered by the retailer’s dedicated fleet of refrigerated vehicles. A driver delivers the order to the customer’s door and, in some cases, unpacks the items onto the customer’s kitchen counter.

- Who Does This: Amazon Fresh, Walmart Grocery, SafeWay, Peapod, Boxed and FreshDirect are some of the retailers offering this service.

- Advantages: Through this approach, some retailers offer free delivery (with a minimum order value). Many provide same-day delivery within a few hours after order placement.

- Challenges: Retailers must manage and operate an ecommerce platform. Retailers must invest in dedicated infrastructure ranging from chilled to frozen warehouses and all the equipment within them to specialized vans and trucks. Fulfillment centers are typically located outside of urban areas, which limits the effective range delivery drivers can service. Delivery routes must be managed strategically to limit fuel costs and avoid traffic congestion while achieving promised delivery times. Although fuel costs can be mitigated for retailers that ship from a nearby store, challenges like those of curbside pickup arise (i.e. dedicated employees, in-store congestion, etc.).

Partnered Delivery

- Placing the Order: In this hybrid of Curbside Pickup and Direct Delivery, the customer places an order from a local store through the provider’s website or mobile app. The customer chooses a date and timeslot for delivery.

- Fulfilling the Order: The provider’s employee visits the store selected by the customer to pick and pack the order.

- Delivering the Order: The employee who picked the order from the store also serves as the delivery driver. Employees use their personal vehicles, much like UberEats and DoorDash, to deliver the order to the customer’s door.

- Who Does This: Two well-known companies providing this service are Shipt and Instacart. Many grocery retailers now partner with these companies.

- Advantages: For the grocery retailer, this service allows their stores to be available for ecommerce without adding an ecommerce platform, brick-and-mortar infrastructure or delivery equipment. No additional store employees are required. For the service provider, operating costs are limited primarily to managing the website or mobile app and paying the employees who pick, pack, and deliver the orders.

- Challenges: Service providers must maintain accurate, current inventories and product locations for items within many physical stores for every participating grocery retailer. Employees of the provider walk the aisles of the stores while fulfilling orders, potentially adding congestion that might sour the experience of other shoppers.

Microfulfillment Centers (MFC)

- Placing the Order: The customer places the order directly on the retailer’s website or mobile app. The customer chooses a date and timeslot for pickup or delivery.

- Fulfilling the Order: Rather than pick the order directly from the shelves of a store or from a large fulfillment center, the grocery retailer’s employees fulfill online orders from an automated storage and retrieval system. MFCs, which may be in urban areas or within existing brick-and-mortar stores, hold inventory specifically allocated for online sales. By removing the need to walk the aisles of a store or warehouse, the MFC leverages automation to help employees pick and pack orders quickly and efficiently.

- Delivering the Order: Both curbside pickup and partnered delivery are options.

- Who Does This: Many grocery retailers are utilizing this approach, including Meijer, Walmart, Albertsons and Kroger.

- Advantages: MFCs offer high-speed, low labor order fulfillment by using automation. The microfulfillment centers require a small footprint relative to traditional fulfillment centers (e.g. 8,000-10,000 sq ft), which means they can be located in urban areas or in underutilized space within an existing store.

- Challenges: As with many other options, retailers must manage and operate an ecommerce platform. They must invest in automated equipment and maintain separate inventories outside the stores and fulfillment centers. If the MFC goes into an existing store, that space could have been used for other purposes. Infrastructure for curbside pickup and/or delivery is still necessary.

Engineering Your Grocery Fulfillment Advantage

Grocery retailers, who had been somewhat insulated from the ecommerce boom until recently, are now clambering to position themselves for success in the ecommerce channel. Many approaches can be taken to fulfill online orders and recognize these sales.

With razor-thin margins on one side of the equation and rapidly changing customer expectations on the other side, each grocery retailer must determine which approach, or combination or approaches, best suits its unique position in the modern marketplace. As an independent integrator that works across a multitude of industries, we strive to design and integrate the right system for you, our customers. If you would like to discuss your solution, reach out to our team at Bastian Solutions.

Dustin Crandall - Dustin is Ops Engineering Team Lead at Bastian Solutions. Dustin has over 10 years of experience in process engineering, conceptual design and project management. Dustin attended the University of Missouri – Columbia where he earned a B.S. in Industrial Engineering. Outside of work, Dustin is an active member of Missions of Mercy, a ministry that provides charity and aid to homeless individuals in Houston, Texas.

Comments

No comments have been posted to this Blog Post

Leave a Reply

Your email address will not be published.

Comment

Thank you for your comment.