Material Handling Automation in Brazil: New Rules for a Changing Market

Guillermo Albaladejo | 27 August 2012

A year ago, Bastian Solutions opened its regional office for South America in the Sao Paulo region, Brazil, under the name of Bastian South America. This new office has brought to the market the first truly independent integrator of the region, with global capabilities to procure ad-hoc technologies for each of our clients. In addition, this office has built up a manufacturing site in which, when the Brazilian Real-USD exchange rate (one that fluctuates a lot!) demands it, we can provide those solutions domestically and otherwise we produce it offshore, always looking at the best price point for the client in each situation.

Brazil, and South America in general, is a very good market as it is expanding, resourceful, demographically buoyant, and with increasing rates of population entering the middle and upper classes, boosting consumption; however, many business models are about to change as this occurs, mainly due to labor cost’s rapid increase. In Brazil and Latin America, return of investment (ROI) from automation is generally fast. We have seen in most of our projects that ROIs of 2 to 4 years are easily achievable, while decreasing operating costs and radically reducing inefficiencies in the processes by implementing some automation (picking and pallet handling being areas where a lot of gain can be achieved with the help of such technologies).

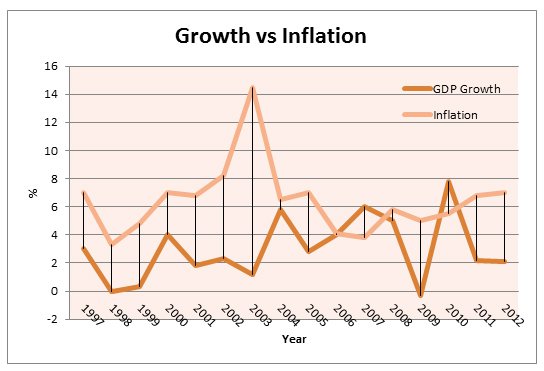

There are companies in the region, however, that do not have the culture of automating processes… yet. Countries like Colombia, Mexico, and Peru spend proportionally more on automation than Brazil. The reason: There is a false feeling that labor in Brazil is still cheap, and the economy grows pretty quick, so you can make good margins without this capital investment. These business models are now starting to suffer. In reality, the economy in Brazil has cooled down quite a bit, nearing a 2% increase in GDP (down from 8% just a year and a half ago), while inflation is ramping up, soaring to 7%. This makes operational costs grow faster than the growth of internal market size, forcing companies to increase price points to cover higher costs and constantly reduce margins to cope with increasingly fierce competition.  We can observe this not only in Brazil but also in many other countries. It appears that BRIC countries (Brazil, Russia, India, and China) will have a harder time growing as fast as they did 5 years ago; don’t get me wrong, these countries still have extremely high potentials and should be the focus of investment for large global corporations, but in order to thrive in this new scenario, companies in Brazil need to give a serious look at optimizing their processes, not only in their production lines but especially in their end of lines (area where there is less focus on optimizing today).

We can observe this not only in Brazil but also in many other countries. It appears that BRIC countries (Brazil, Russia, India, and China) will have a harder time growing as fast as they did 5 years ago; don’t get me wrong, these countries still have extremely high potentials and should be the focus of investment for large global corporations, but in order to thrive in this new scenario, companies in Brazil need to give a serious look at optimizing their processes, not only in their production lines but especially in their end of lines (area where there is less focus on optimizing today).

Without a doubt, NOT automating is expensive. Another data point that we can look at is how inefficiencies in processes and high production costs due to labor is costing competitiveness to many companies in Brazil (paired with the eerie global economics). Industrial output fell at the beginning of 2012 by about 2% (now rebounding a little with an expansion of 0.2% in the month of June, still far from the 0.9% forecasted), and export output has contracted over 14% in June. Brazil has a strong industrial backbone with a large number of universities and many areas of technology excellence.

Optimizing processes ensures that producers in Brazil will not only be able to cope with competition from its BRIC partners, but also with the upcoming powers such as the CIVETS (Colombia, Indonesia, Vietnam, Turkey, and South Africa). However, not all markets are the same. Dealing with processes in each country requires someone with regional knowledge that understands the subtleties of that market and how to go about the right automation process. The differences in salary, inflation, population density, and distance from the factory or distribution center to the end user, fuel prices, price of land (and its appreciation), and taxation are some of the inputs to consider when planning and implementing an automated system for a specific operation.

Each market (and each industry within) requires its own levels of automation and in different areas of the process. It is important to work with an integrator that is objective, independent in its solution, and also experienced in the requirements of each market to obtain beneficial ROIs and rates of increase capacity aligned with the economic growth. This is what Bastian South America brings to the table, a service that has paid out our clients and allowed our global group to grow incredibly strong across the world.

Comments

Teresa Cañedo says:

8/28/2018 10:08 AM

It´s a quite intelligent analysis and prove an excelent knowledge about economic idiosincracy of different latin american countries.

Jose Fernandes says:

8/28/2018 10:08 AM

The post of Teresa y also quite intelligent

Ken Tinnell says:

8/28/2018 10:08 AM

Good analysis - the ability to automate = the ability to compete in the global market place.

Leave a Reply

Your email address will not be published.

Comment

Thank you for your comment.